Don’t invest unless you’re prepared to lose money. This is a high risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Take two minutes to learn more

AutoLend

Making it as easy as possible for Lenders, both passive and active, to build a diversified loan portfolio. The AutoLend functionality gives Lenders full control over how and when they invest.

Always On - turn it on and leave it on

Always On - for the hands off investor

Lowest Risk Investment

Only invests in Tranche A, capped at 50% of the value of the property and for maximum term of 3 years

Automated and Diversified Lending

Subject to availability and available funds, Always On will look to invest in Tranche A of every loan to build you a diversified loan portfolio

Passive 5%* target return

Truly passive 5%* target return, turn it on and leave it on. Average return 7.02%* p.a. for 2018 to 2022

Always On

1

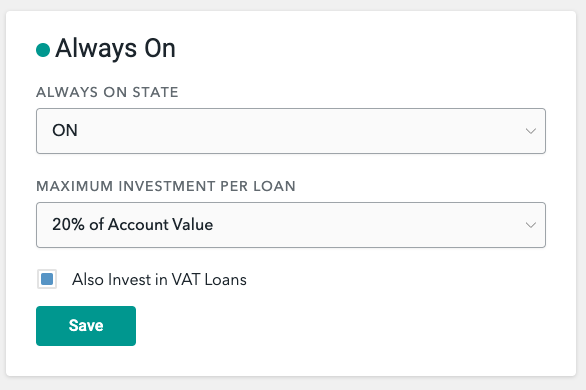

Activate and select the maximum to invest in each loan

2

Repaid capital queued for reinvestment

3

If turned off, it cannot be reactivated for 30 days

4

Can be activated in Classic, ISA and Pension Accounts

5

Minimum £1,000 investment into each loan

THE BEST OF BOTH

You can opt into "Always On" for automated investment into Tranche A, AND invest in Tranches B & C via "Self Select"

Self Select - All the benefits of manual investing, just automated.

Self Select - for the hands on investor

Like manual investing, only better

For the hands on investor who likes to read the supporting material on a loan by loan basis then choose which loans to invest in.

Total Control

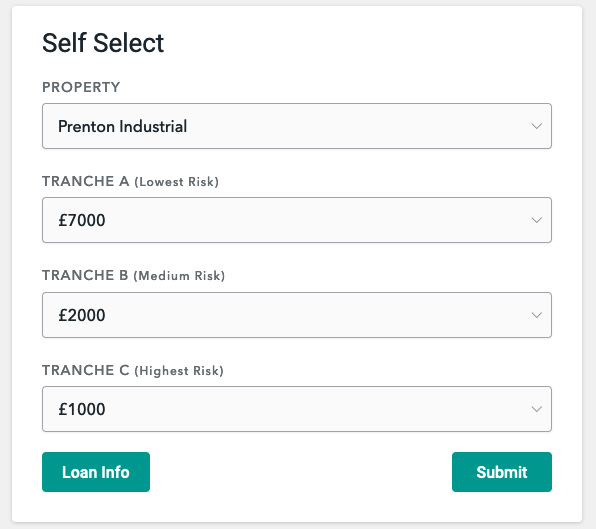

Lenders preselect which tranche (s) to invest into and the maximum investment in each tranche (subject to availability)

Don't miss out

Lenders notified at least 24 hours in advance as each new loan comes to the platform

Self Select

1

Control to invest on a loan by loan basis

2

Receive notification as each new loan comes to the platform

3

Full access to Loan information, (Loan Request and Valuation)

4

Select the maximum amount to invest (subject to availability)

5

Minimum £1,000 investment into each loan