Don’t invest unless you’re prepared to lose money. This is a high risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Take two minutes to learn more

How it works

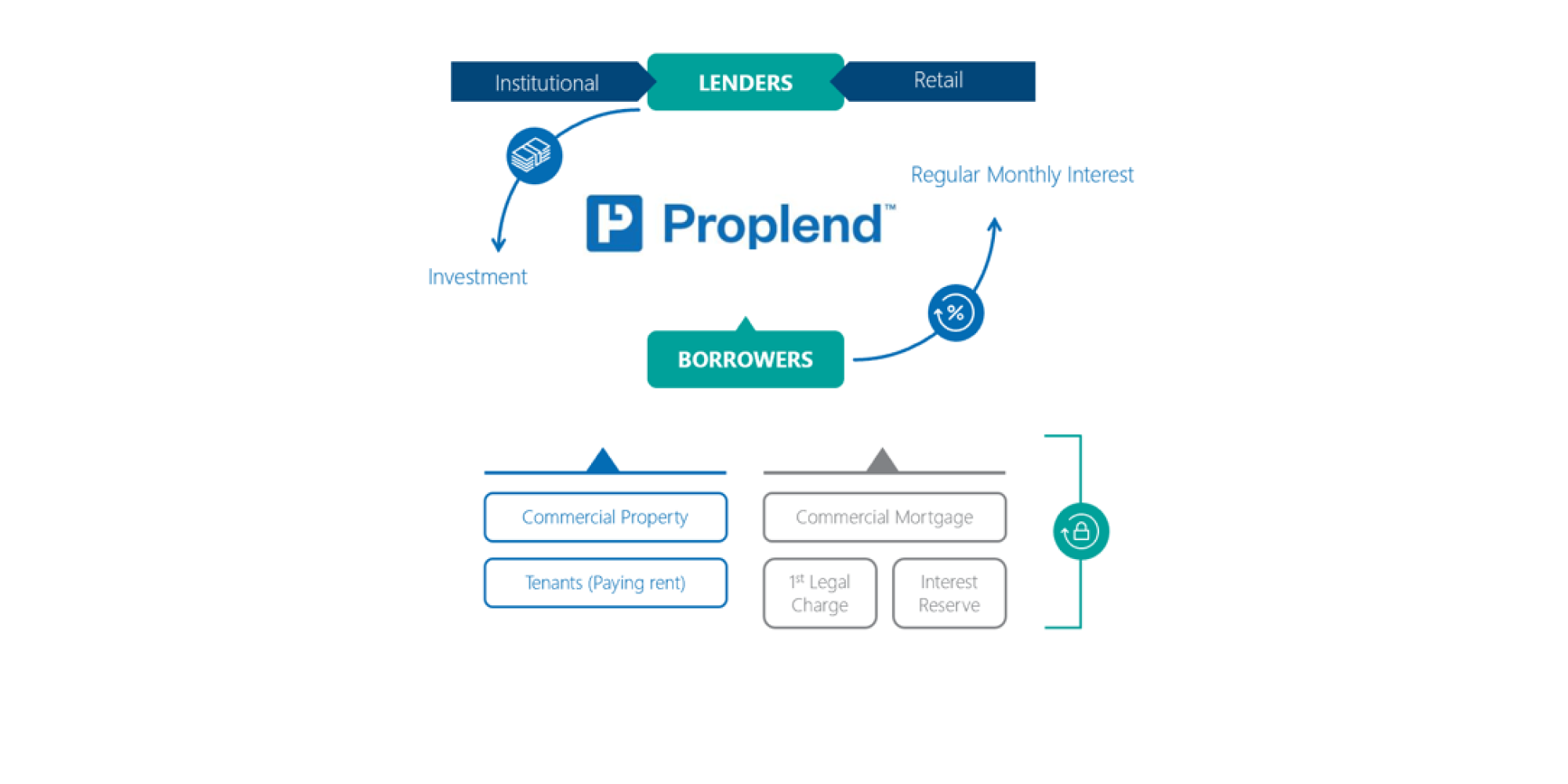

Lend money to commercial property investors (the Borrower), secured by a 1st legal charge over a commercial property and earn regular monthly income.

Platform Statistics

267

No of Loans Funded

189

No of Loans Repaid

£9m+

Interest Paid (Before Fees)

£168m

Capital Repaid

What We Do?

Proplend originates credit worthy Borrowers, conducts due diligence, sets the interest rates, distributes the loan for investment, closes the loan and manages the loan & interest payments throughout the life of the loan. It’s a cradle to grave service from origination to redemption.

Originate & DD

Originate credit worthy Borrowers, conduct internal & external due diligence

Price the Loan

Set Loan & Tranche Interest Rates using our proprietary risk pricing matrix

Distribute, Execute & Close

Distribute, document, execute & close the transaction.

Monitor & Service

Collect & distribute monthly interest payments & monitor the ongoing loan

What you do?

We give you, our Lenders, full control to invest and earn regular monthly interest via the transparent interactive platform

01

Register

Register on the platform and choose your account type; Classic, ISA, Pension or Wealth Manager

02

Fund

Fund your account, subscribe to or transfer in existing ISA's or Pension monies

03

Invest

Choose how to Invest; automatically via Always On or manually via Self Select and level of Tranche Risk

04

Earn

Receive regular monthly interest payments, which you can withdraw or reinvest

Matching Commercial Property Investor demand for Loans with Lender demand for regular monthly income.

Transparency & Control

Our secure online Lender dashboard gives Lenders control to manage their accounts, plus provides information to enable them to make fully informed investment decisions on a loan by loan basis. Lenders have total control of the level of Risk and Return they are willing to invest in.

Lender Fees: Interest is paid gross into Lenders Proplend account following which Proplend deducts our 10% Lender Fee.

If a Lender sells a loan part on the Proplend Loan Exchange (PLE) there is a 0.5% (£5 per £1,000 loan part) fee charged on the face value of the loan part.

Risk & Returns

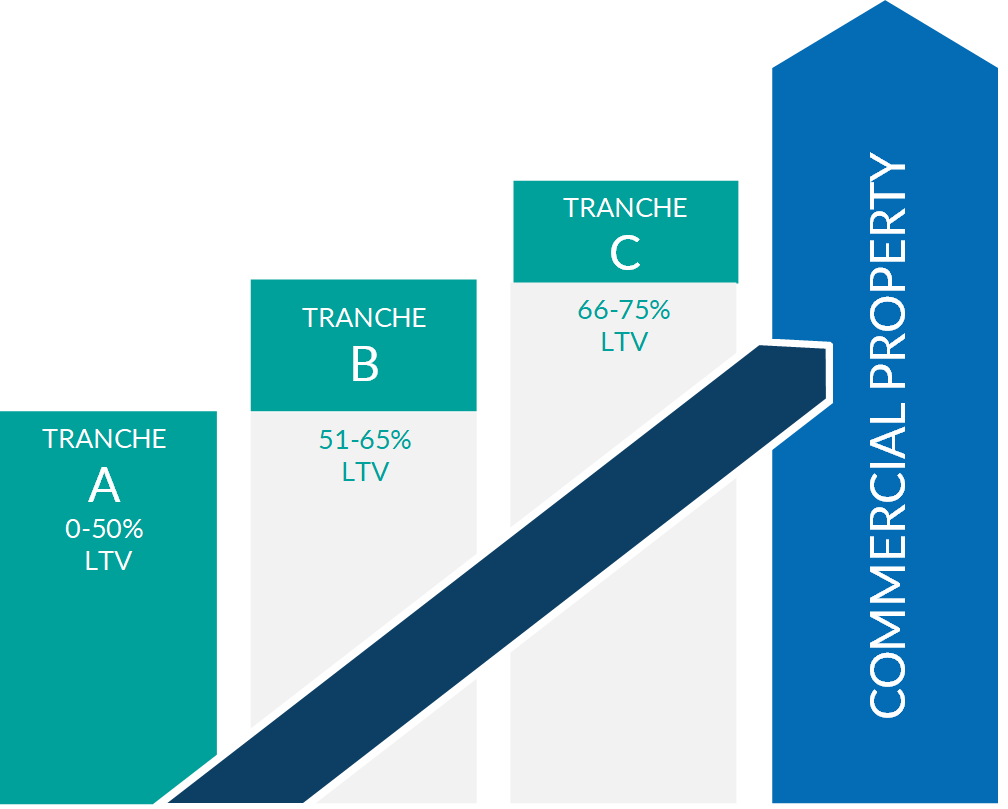

Proplend splits loans in up to three LTV based risk tranches, this means Lenders with different risk parameters and return requirements can all participate in the same loan.

The higher the Tranche or LTV, the higher the risk but the greater the expected return.

Tranches:

Tranche C offers the Highest Risk covering 66-75% LTV

Tranche B offers Medium Risk covering 51-65% LTV

Tranche A offers the Lowest Risk covering 0-50% LTV

Depending on the LTV of the whole loan will dictate which Tranches are available on a loan by loan basis.

Average Annual Interest Rate (Avg. AIR)*

6.05%

Tranche A

(0-50% LTV)

7.87%

Tranche B

(51-65% LTV)

9.81%

Tranche C

(66-75% LTV)

*Annualised percentage return after fees, but before bad debt and taxes for active loans on the platform for the 12-month period to 31 December 2022, with Interest not re-lent. Calculated taking an average of the Annual Interest Rate (AIR) across all loans. The average AIR isn’t weighted based on the value of monies lent and assumes that the average AIR is achievable based on lending the same amount to all loans listed on the platform. Past performance is not a reliable indicator of future performance. Tax treatment depends on individual circumstances and may be subject to change.