Don’t invest unless you’re prepared to lose money. This is a high risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Take two minutes to learn more

Getting Started

We have made it easier for time constrained investors to build a diversified loan portfolio and earn attractive rates of regular monthly interest.

Choose your account type

Choose account relevant to the funds you will be investing. Classic account for taxable income or an ISA or a Pension Account and enjoy tax free income

Register on the platform

Complete the online registration, categorise your investor type and complete the FCA mandated appropriateness test.

Fund your account

Fund your account by sending money to our Client Money Account, subscribe or transfer in your ISA or transfer Pension monies

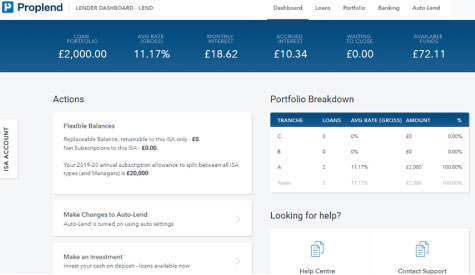

LENDER DASHBOARD

Your dashboard is the only place you’ll need to go for everything Proplend!

Log in securely to your Lender Dashboard where you can invest and manage your account, as well as accessing help, contacting us and updating your email communication preferences.

If you have a Classic and ISA Account, you’ll use the same login for both – you’ll just need to make sure you’re in the correct account dashboard. The account you’re in is clearly signposted on the left of your Dashboard.

Account Types?

Lending Account Types

1

'Classic' account - Unlimited but taxable

Invest as much of your cash, whenever you want.

2

Innovative ISA account - Tax-free returns

Invest in our loans through our Flexible Innovative Finance ISA and earn the same fixed income returns, tax free.

3

Pension Investments via your SIPP/SSAS

Invest via either a SIPP or SSAS pension wrapper. Same returns but loan interest accrues tax free.

Decide how you want to invest

Invest automatically via Always on (Tranche A only) or pick and choose your investments on a loan by loan basis via Self Select. Minimum investment is £1,000

Decide level of Risk & Return

Once you have read the Loan supporting information (Full Loan Request and Valuation) decide what level of risk and return you wish to invest in

Proplend Loan Exchange (PLE)

Should you decide to sell a Loan part before the loan maturity date, you can place it for sale on the PLE, where another Lender may purchase it. Liquidity is available but not guaranteed.

REGISTER AS A PROPLENDER

Inflation-beating commercial property-backed loans. All capital at risk

“Proplend has been awarded our top rating [exceptional] for its Tranche A product. Protected by property that’s valued at more than twice the size of the loan. Borrowers must also ‘reserve’ three to 12 months of loan interest payments in advance.”

4thWay

“Fantastically good security backed up by steady borrower income”

“I have been investing in P2P loans for a few years now. I came across Proplend and liked their proposition and transparency, and decided to give them a go. I’ve made several investments now and am increasing the capital I commit. Good reporting, no surprises so far, and they seem very willing to communicate”

David, Proplend Investor

“I have introduced some clients because of the confidence I feel in them.”

GET IN TOUCH

Convinced yet? Let's make something great together.

Address

15 Little Green, Richmond,

TW9 1QH

TW9 1QH

Phone

0203 951 7970