Peer to Peer Lending platforms are growing in popularity and each offer unique opportunities to invest. Based on this rapid growth it could be hard to differentiate how each platform works, and which will give you the best return based on your investor profile?

While we cannot advise you on what to invest in, we figured it would be nice to give you a very brief “How to Invest” guide for Proplend.

What type of Peer to Peer Loan are you investing in when using the Proplend Platform?

• Borrower is the owner of a commercial property

• Property is Income producing with existing tenants paying rent

• Fully transparency on the borrower, the property and the tenants

• Invest on a deal by deal basis

• Direct loan contract between the borrower and lender

Why Commercial Property?

• Limited capital risk

• Reliable and attractive documented source of income from Full Repair Lease (FRI Lease)

• Low correlation with other assets

• Loans are supported by a 1st legal charge over the property

o In the event of default, Proplend investors have the first rights on any funds available from the sale of the property

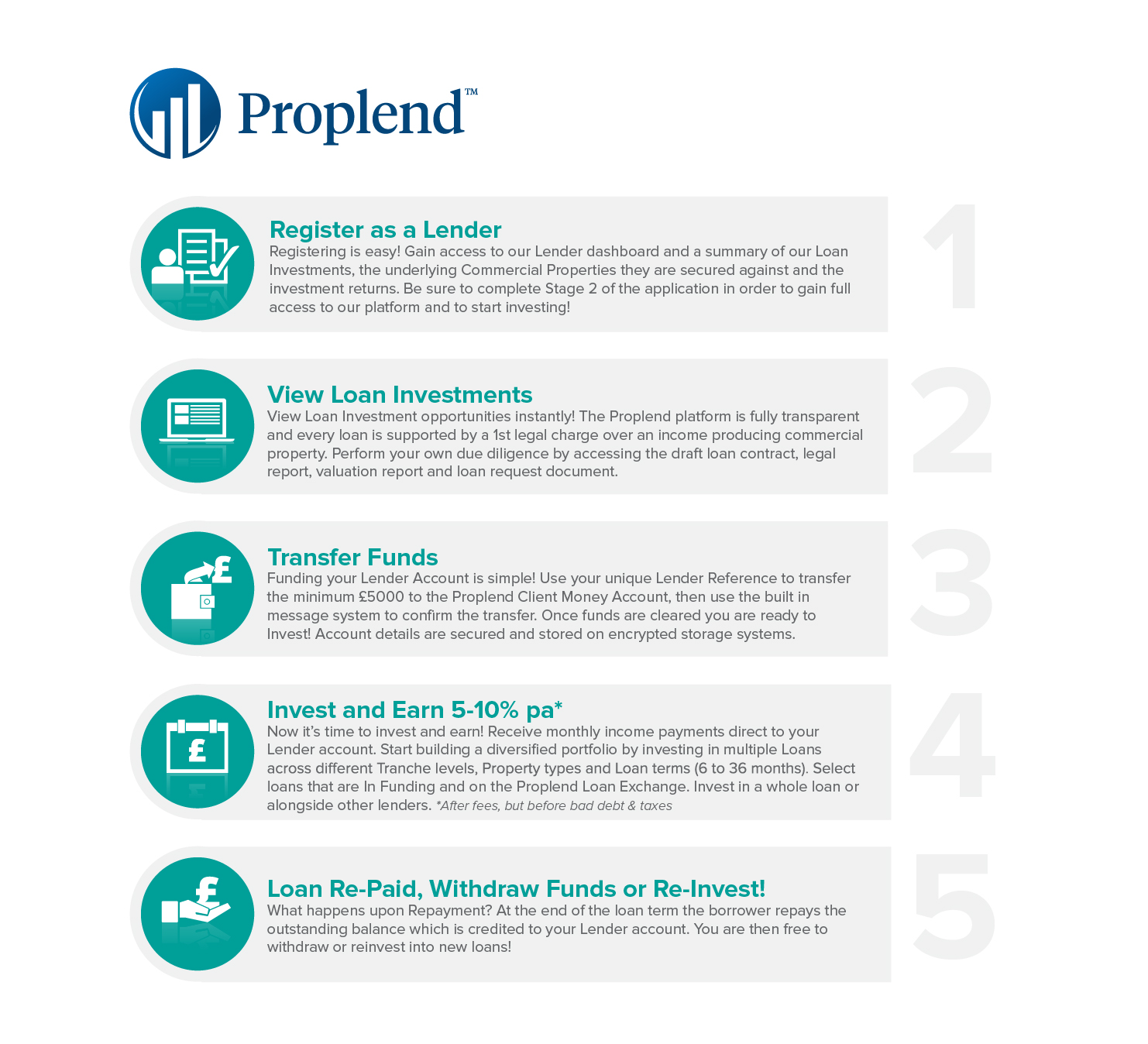

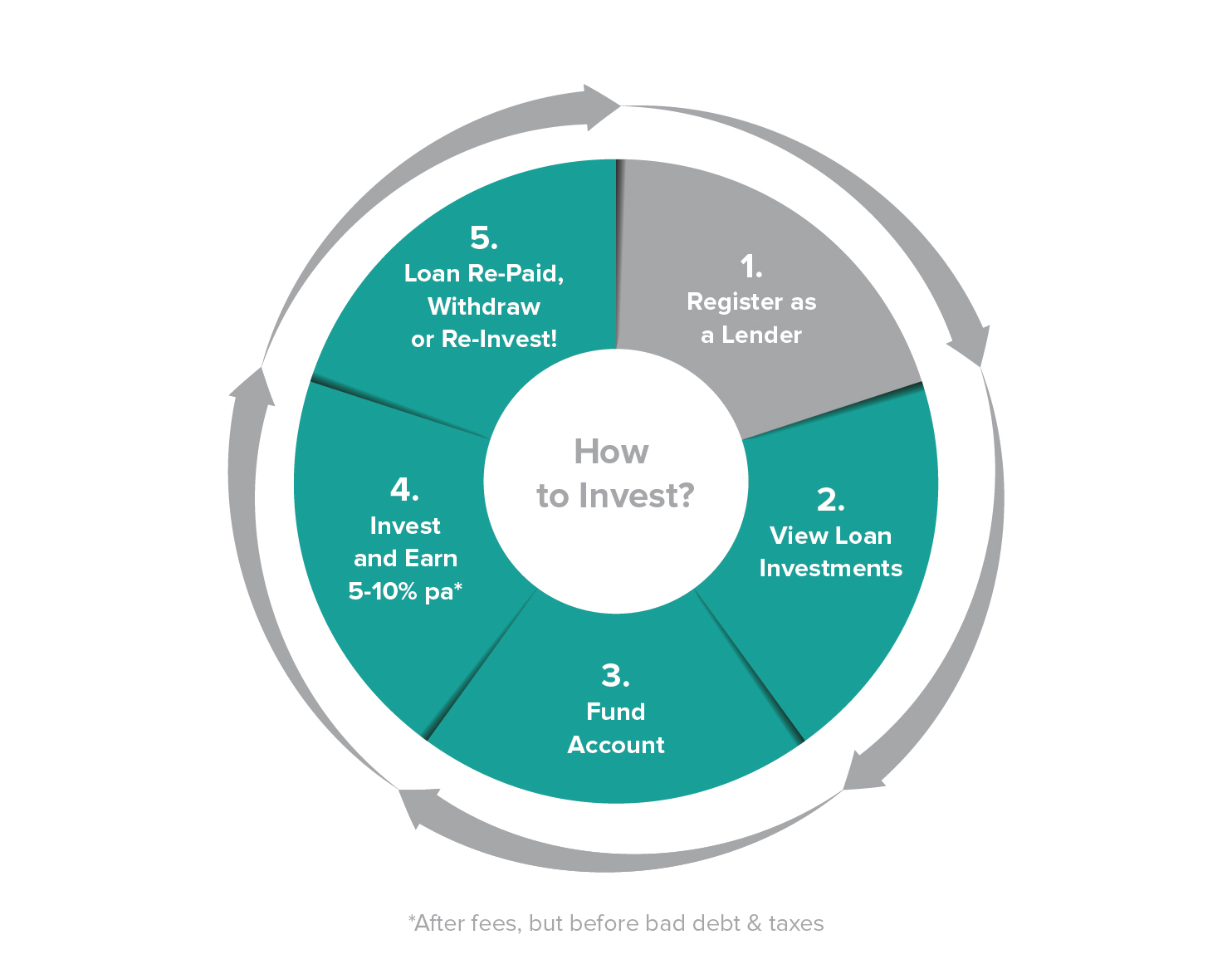

How To Invest

5 easy steps:

We encourage you to Register Today to view all Loans Investments. Please also contact us at [email protected] if you have any immediate questions.