Proplend welcomes a wide range of investors from individuals to family offices and institutions, giving them all the opportunity to invest alongside each other. Diversity is good but we recognise that not all investors have the same attitudes towards risk and return.

We developed the Proplend Loan Tranche in order to give our investors the most choice and an opportunity to invest into a wide variety of loans offering returns of 5% to 12% pa**.

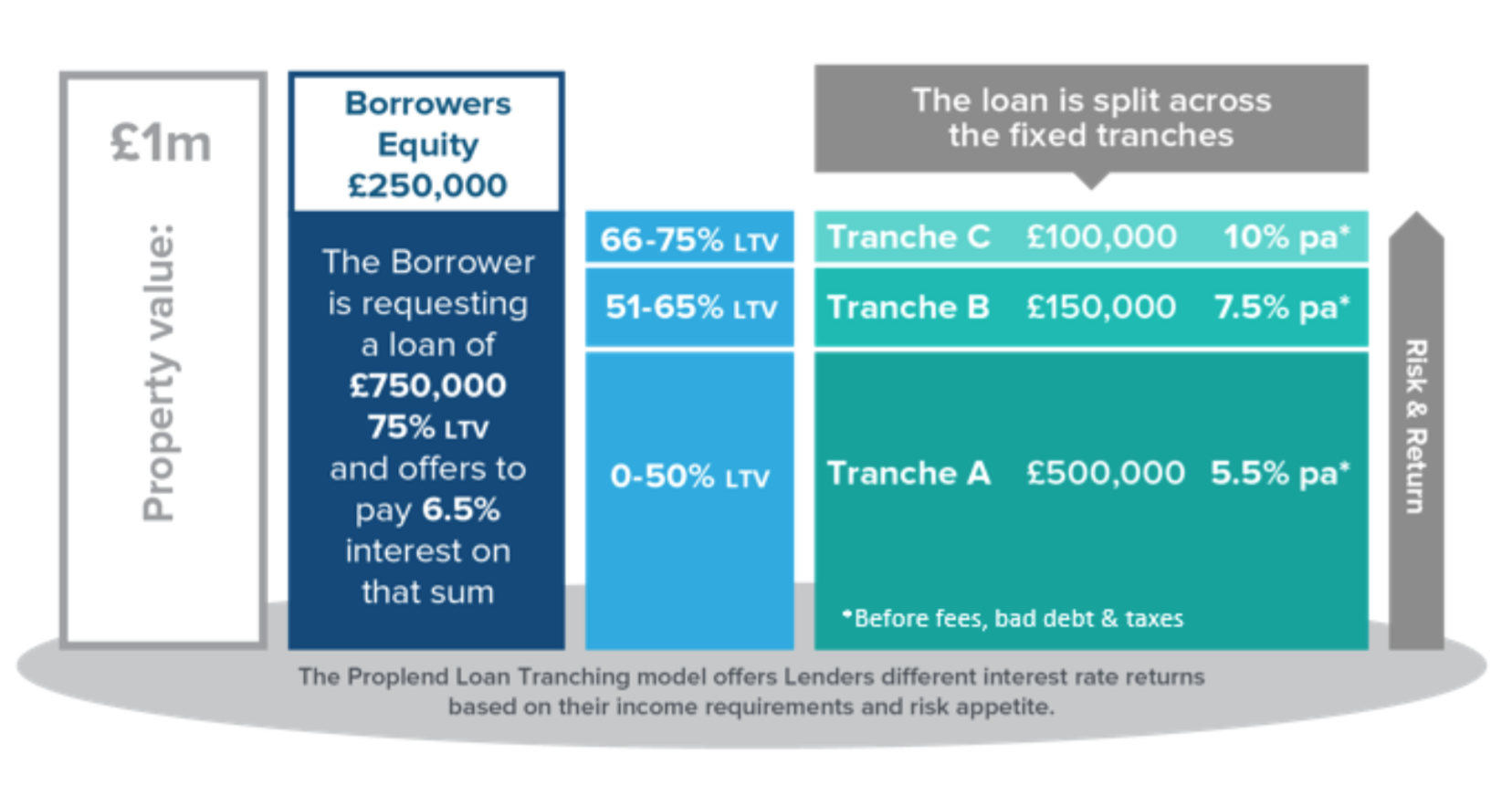

The Proplend Loan Tranche breaks down each Loan into up to three LTV based tranches, which allows all investors the opportunity to invest in the same loan, even if they have different risk parameters and return requirements.

How It Works

All Proplend loans are secured with a first legal charge over the property, which means if the borrower fails to meet interest payments or repay the loan at the end of the term, the property can be sold and the proceeds used to redeem the loan and repay the investors.

Borrowers are able borrow a maximum of 75% of the value of the property, known as the Loan to Value (LTV). The value is important, as the borrower has to sell or refinance the property at the end of the term in order to repay the loan. It is the difference between the amount of the loan and the value of the property that gives investors their protection. For example: in the case of a 75% LTV loan, the property would need to fall over 25% in value before the investors’ underlying loan would be at risk. If a loan has a LTV of 50%, then the property value would need to fall by more than half before the investors’ capital would be at risk.

A riskier investor is more likely to invest in a Tranche C level loan with a 75% LTV that offers a higher return. A modest investor will most likely stick to a Tranche A loan with a 50% LTV, which still gives attractive returns but with greater capital protection. Tranche A investors have the opportunity to participate in every loan rather than waiting for a 50% loan to value loan. Many investors will also choose various loans with different Tranche levels, in order to diversify their portfolio.

Tranches

By splitting each Loan Investment into LTV based tranches, investors have the opportunity to decide on the level of risk they want to accept and the level of protection they require on their investment.

Three Tranches are created based on the LTV of the Loan:

- Tranche C 66-75% LTV Higher Risk: 133% of capital protection

- Tranche B 51-65% LTV Medium Risk: 154% of capital protection

- Tranche A 0-50% LTV Lower Risk: 200% of capital protection

The higher up the Proplend Loan Tranche you invest, the higher the return you will receive. The lower down the Proplend Loan Tranche you invest, the lower return you will receive, but you are offered increased capital protection.

At the end of the loan term, investors will have their loan investment repaid plus any outstanding interest due with Tranche A investors being paid first, Tranche B second and Tranche C third.

Not only does Peer-to-Peer lending require many lenders, but it also requires many different types of lenders. The Proplend Loan Tranche provides such a solution.

The Proplend Loan Tranche

**After fees, but before bad debts and taxes