Filter by:

Proplend’s Borrower relations and underwriting team have a combined 60 plus years in the property finance industry. This highly experienced and trusted team is responsible for the due diligence process and to date they have delivered a zero default rate. After a Borrower submits their Loan Request using our

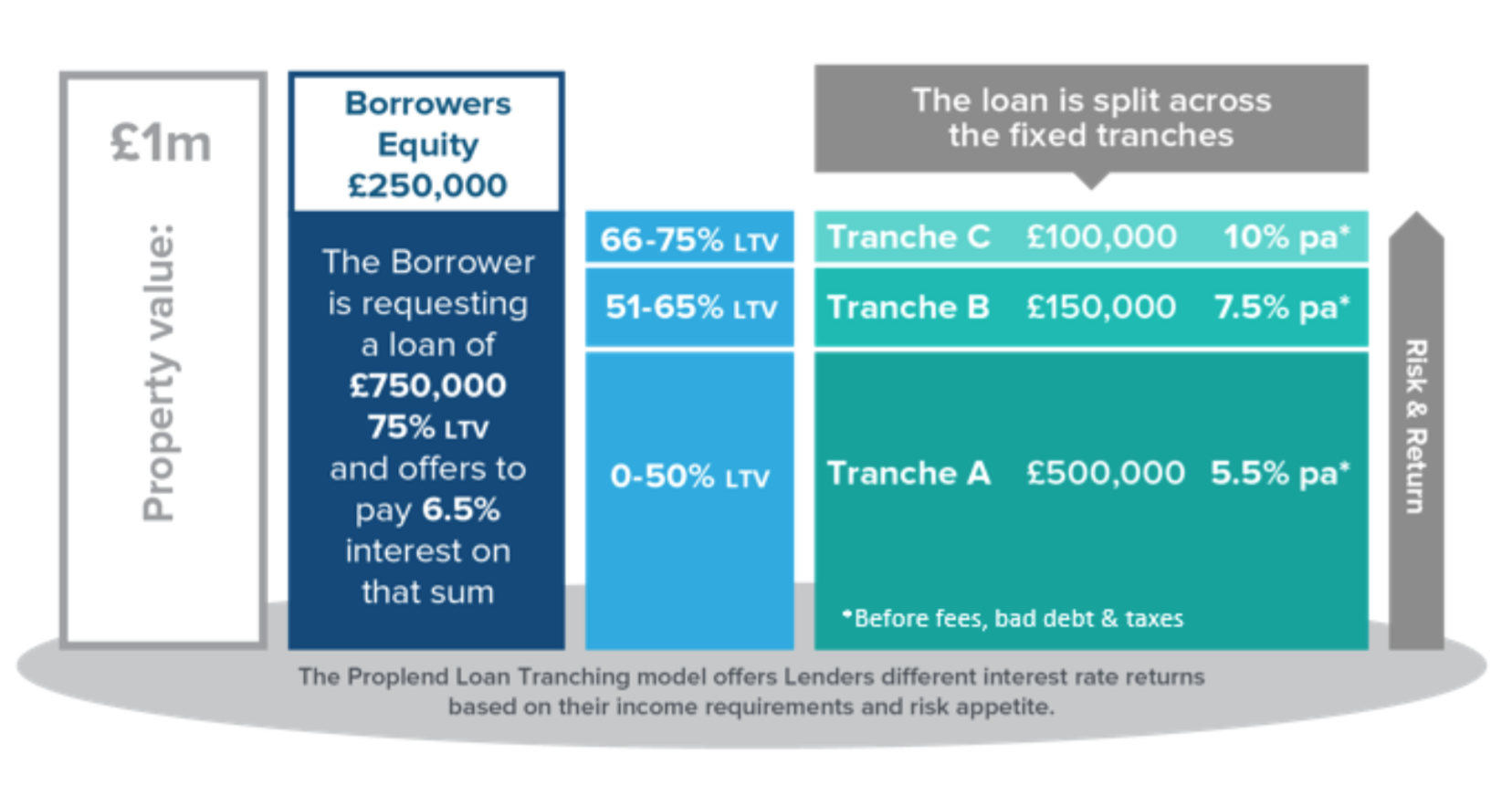

Proplend welcomes a wide range of investors from individuals to family offices and institutions, giving them all the opportunity to invest alongside each other. Diversity is good but we recognise that not all investors have the same attitudes towards risk and return. We developed the Proplend Loan Tranche in

Bonds and Peer-to-Peer (P2P) loans are both fundamentally debt instruments. They both produce similar returns and offer investors, in the current long term low interest rate environment, with much needed regular fixed income. It’s impossible to make a direct comparison as there are different types of bonds and there